Managed Care Litigation Update® Preview

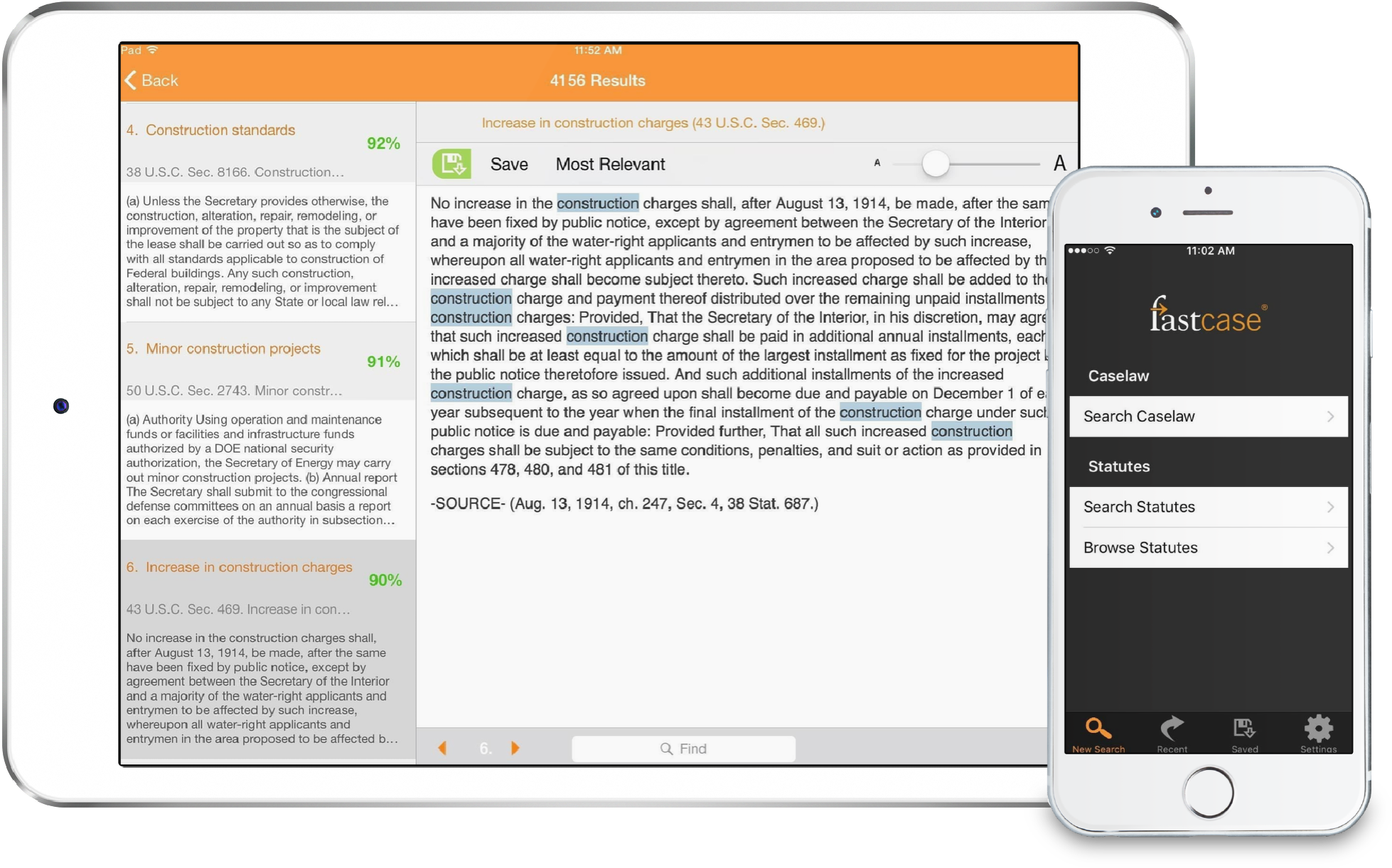

Jonathan M. Herman’s Managed Care Litigation Update® biweekly newsletter will soon be available on the Fastcase legal research system. Mr. Herman is a seasoned lawyer who has spent much of his legal career representing large health insurers, plan administrators, and self-funded health plans in managed care disputes, often arising under the provisions of the Employment Retirement Income Security Act (ERISA). Now, he is bringing his expert knowledge to Fastcase. The full Managed Care Litigation Update® subscription will include complete case information, as well as special quarterly and annual summary issues.

Interested in subscribing? Contact our Sales team at sales@fastcase.com or 202.999.4777.

Newsworthy

|

Recently filed actions

|

|

|

Putative class action filed against Centene on behalf of Ambetter policyholders who allege inadequate network access in 15 states. Cynthia Harvey, et al. v. Centene Corporation, et al., U.S.D.C. E.D. WA, No. 18-00012 (01/11/18, Doc. 1).

Humana leaves insurance lobby group America’s Health Insurance Plans, in addition to prior departures by Aetna and UnitedHealth. http://www.washingtonexaminer.com/humana-becomes-third-large-health-insurer-to-leave-top- lobbying-group/article/2645512

Court grants 12(b)(6) motion to dismiss in favor of United, in ERISA and RICO class action alleging defendants caused their network pharmacies to charge excessive amounts for prescription drugs, then clawed back the excess and unauthorized charges. In re UnitedHealth Group PBM Litigation, 16-3352, D. MN (Doc. 171, 172, 12/19/17). See also MCLU Vol. 66. Other “claw back” cases covered in MCLU Vol. 66, 68, 69, 70, 71. |

Parents of minor child seek recovery of over $135,000 in mental health benefits associated with “medical care and treatment in the State of Utah at New Haven Residential Treatment Center.” Coverage was denied on grounds that “E.’s ‘behavior was in control throughout [that] period,’ and that she did not require 24-hour care” (brackets in original). “UBH provided that E. could have been treated in an intensive outpatient setting instead of residential treatment facility.”

Removed action in which “the business agent of the physicians of the faculty of the New Jersey Medical School…” seeks recovery of $193,309.00, as “[UCR] value of the claims …,” from both the patient and health insurers associated with pre-authorized spinal surgery. Plaintiff additionally alleges, “the Insurance Company Defendants subsequently processed benefits payable only to Joseph Calderone or [his wife] in contravention of … N.J.S.A. § 26:2S-6.1(c).”

Hospital and alleged assignee seeks recovery of $30,916.76 for services rendered to a patient, where billed charges totaled the same amount and “[t]he Defendants have paid $0.00 for this claim.” “The Defendants and/or their agents denied the majority of the claims by contending that the treatment was performed out of network.” Plaintiff responds that the treatment was “due to an emergent health condition [surgical repair of a complex fracture with specialized instrumentation not available at ER of prior hospital transport] that prevented her from seeking treatment at an in- network provider.” Multiple lawsuits by this provider against major carriers reported in prior MCLU issues. |

Provider of air ambulance services seeks recovery of unspecified charges associated with air transport from Kansas for patient to “begin intensive neurological rehabilitation … at Texas Institute for Research and Rehabilitation [ ]” following car crash. “Cigna refused to preauthorize the services and denied the claim, asserting without explanation that Jason could be treated at unspecified-but-closer rehabilitation facilities.” Other actions by this provider reported at MCLU Vol. 43, 47, 48, 49, 51, and 75.

Removed action in which rehabilitation facility and alleged assignee submitted bills in the amount of $73,318.40 to defendant but received payment of $4,353.60, leaving a balance of $68,964.80 for which plaintiff seeks recovery. Basis for payment made is not set forth in underlying Complaint. Another action filed by this provider and reported in MCLU Vol. 66.

Parents of minor child seek recovery of mental health benefits associated with “mental health treatment from Outback Therapeutic Expeditions … a short-term wilderness treatment program in Utah … and at New Haven Residential Treatment Center …” Coverage was denied at Outback” as [Aetna] did not consider M.’s treatment medically necessary [and that] under its LOCAT criteria, M. was not at risk for harm, and consequently could have been treated in an outpatient program or with partial hospitalization.” Coverage was denied at New Haven because the “[t]reatment could be provided at a less intensive level of care or in another setting …render[ing] the treatment not medically necessary …”

Parents of minor child seek recovery of more than $130,000 in mental health benefits associated with “treatment for his mental health conditions at Catalyst Residential Treatment Center [ ] in Box Elder County, Utah.” Coverage was denied “on the grounds that M. could have been treated at a lower level of care.”

Parent seeks recovery of mental health benefits on behalf of minor child, for treatment of separation anxiety, depression, and generalized anxiety disorder. Child was enrolled in Change Academy at Lake of the Ozarks, a residential treatment center for preteens and teens in Lake Ozark, Missouri. Benefits were denied on grounds that “a residential treatment program was ‘not medically necessary, as that term is defined under your health benefit plan.’” Plaintiff further alleges a violation of §376.1550 of the Revised Missouri Statutes, mandating parity between group health plans offering health benefits and mental health benefits.

Removed action in which OON physician seeks of charges associated with surgery to treat multisultural synostosis and worsening cranial deformity. “The total amount billed was $123,166.50; the total amount allowed was only $8,839.03.” “There were no comparable alternatives to Dr. Schneider and Plaintiff’s group that were in Defendant’s network at the Hospital…” Other actions filed by this provider reported in MCLU Vol. 78, 81, 92, 93, 94.

Provider and alleged assignee contends it rendered medical service to patient (“cervical diskectomy and fusion procedure [and other procedures]”). Plaintiff submitted HICF claim forms in the amount of 1,090,750. “Defendant, however, issued payment in the amount of only $18,519.57.” Basis for payment made is not stated in the Complaint. Other actions filed by this provider and reported in MCLU Vol. 92, 95.

Parents seek recovery of mental health benefits associated with child’s “medical care and treatment in Utah at Aspiro Wilderness Adventure Therapy [wilderness therapy program], Maple Lake Academy [ ] and Viewpoint Center [residential treatment centers].” Coverage was denied at Aspiro on grounds that “[t]his is an unproven and experimental type of treatment [and h]er care could have occurred in an intensive outpatient program.” Coverage was denied at Maple Lake on grounds that “[t]here was no evidence of behaviors that could not have been managed in an outpatient setting.” Coverage was approved for treatment at Viewpoint up to a date certain and denied thereafter on grounds that “[y]ou no longer need residential psychiatric care.”

Removed action in which plaintiff alleges having cancelled a health policy as of December 31, 2015, and that confirmation was received, but that “Humana failed to cancel the Policy … and continued to draft premium payments from Mr. Garner’s bank account in the amount of $893.42 per month.” “By the time Mr. Garner noticed Humana’s error, a total of $10,721.04 had been wrongfully drafted …” (bold, underline emphasis in original).

Removed action in which “fiscal agent for West Hudson Post Acute Care Center …” contends a patient received skilled nursing care services and that claims for payment were denied by Aetna. Basis for non-payment is not stated in underlying Complaint.

Removed action in which OON surgeon seeks recovery of approximately $15,000 associated with services rendered to a patient who presented to the emergency room with a 3-cm laceration. “FAIR Health assigns a value of $22,130.91 as the reasonable and customary value …” “Defendants paid a total of $1,672.41 for the surgery performed … [and] represents a gross underpayment …” Basis for payment made is not stated in underlying Complaint.

Removed action in which plaintiff alleges being diagnosed with a seizure disorder for which he takes Lamictal, which was covered by Defendants until July 2015, whereupon “the defendants made a decision to not pay for the Lamictal prescriptions for the plaintiff but only pay for a generic medication.” Plaintiff alleges suffering seizures on the generic medicine and the defendants agreed to pay for Lamictal, but now can no longer operate a motor vehicle and other activities due to the medication change.

Member seeks recovery of benefits associated with emergency care for his minor son, for “new onset diabetes” and 5 days of hospital care. Plaintiff alleges having gone to an in-network facility, “but Defendants pretended that the facility is not in-network in order to avoid paying for the care.” “Furthermore, since the services were emergency services, all such care is treated as in-network care.”

Removed action in which provider of emergency air ambulance services alleges it was “grossly underpaid” for the Services [as defined] rendered to Defendants’ members. Plaintiff alleges that pursuant to Fla. Stat. §§ 627.64194(4) and 641.513(5), it should be reimbursed the lesser of its charges, the UCR for similar services in the community, or the charge mutually agreed by the parties within 60 days of submission. Basis for payment made (alleged underpayments) is not stated in the underlying Complaint. Similar actions filed by this provider and reported in MCLU Vol. 92, 93.

Non-profit organization that “fosters the ability of primary care physicians to provide high quality, patient accessible diagnostic and therapeutic allergy and asthma care” filed antitrust case contending the defendants “restrict competition in the relevant markets for allergy testing and allergen immunotherapy for seasonal and perennial allergies …” “By refusing to pay anything for allergy testing and immunotherapy services and coercing primary care physicians to stop working with UAS, Defendants have denied UAS the ability to compete in the market.”

Plaintiff “is an 18-year old young woman who has a history of mental illness, including anorexia nervosa” who seeks recovery of benefits associated with “residential treatment at Avalon Hills Treatment Center.” “Blue Cross initially approved and paid for Jessica’s residential treatment at Avalon Hills” but denied after a certain date “on the basis that treatment was not medically necessary.” Plaintiff additionally contends that “Blue Cross underpaid for Jessica’s treatment and failed to pay for her treatment at an in-network or SCA rate” which was alleged to have been promised given the lack of an in-network facility within 50 miles.

Plaintiff, who “suffers from anorexia nervosa … and other physical and mental illnesses,” seeks recovery of mental health benefits associated with inpatient treatment at Sheppard Pratt Health System. Defendant approved plaintiff’s request for precertification for successive periods, but would deny claims after the approved period “on the grounds that Plaintiff was not improving and continued stay would be considered ‘maintenance services’ [or custodial services] which are not a covered benefit.” Due to an erroneous overpayment for an approx. 3-week period, “Defendant [stated it] would seek recoupment of their payment.”

Father seeks recovery benefits on behalf of daughter who has Asperger’s Syndrome and “received medical care and treatment at La Europa Academy [ ], a residential treatment facility in Utah …” Benefits were denied on grounds that the care was not medically necessary, but an external reviewer partially overturned that decision for an approximate two-month period. The approximate 8-month remainder of treatment was upheld as not medically necessary. The patient was previously admitted to Pacific Quest, a wilderness therapy program in Hawaii, for which coverage was denied but that denial does not appear to be at issue in the Complaint.

Parents seek recovery of benefits on behalf of their child for mental health care and treatment received in the State of Maine at Summit Achievement, in the State of Georgia at Second Nature Wilderness Family Therapy, and in the State of Arizona at In Balance Ranch Academy. Claims for Summit were denied on grounds that the submission was outside of the Plan’s one-year limitation. As to claims for treatment at Second Nature, “UBH asserted that the Level of Care Guideline for Residential Substance Use Disorder Treatment did not warrant coverage …” Claims for In Balance were denied as being not timely filed and “that In Balance had not notified UBH of Charlie’s admission and treatment.”

Removed action in which medical practice specializing in plastic and reconstructive surgery alleges it provided services to a patient (multi-stage breast reconstruction surgery). Total bills were $292,742 and payments made were approximately $95,000. Basis for payments made is not stated in underlying Complaint. Other actions by this provider covered in MCLU Vol. 77, 89, 95.

Medical provider and alleged assignee contends that “[o]n various dates of service in 2014 through 2017, Plaintiff provided medically necessary and reasonable emergency services to Patients” for which HICF forms were submitted totaling $44,826.00. “Defendant, however, only allowed reimbursement totaling $6,696.99 …” In addition, “Plaintiff brings this action for failure to comply with N.J.A.C. 11:4- 37 [cost sharing applied to the covered person for emergency care shall be the same regardless of whether the services were rendered by network or out-of-network providers]…” Neither nature of services nor basis for payment made are stated in the Complaint.

“[M]ulti-specialty physician practice that is affiliated with Wilson N. Jones Regional Medical Center” alleges that, due to corporate restructuring, it acquired a new tax identification number but that the old entity was contracted with BCBS. Plaintiff submitted 1,725 claims, with cumulative charges of $343,728.00, under the new tax ID number while it was attempting to finalize a new provider agreement. “BCBS denied the claims as being out of network … BCBS has also failed to even pay out of network benefits for the services …”

|

Jonathan M. Herman is the founding member of Herman Law Firm, where he represents health insurers, plan administrators, and self-funded plans in plan reimbursement disputes. Herman Law Firm has offices in Dallas, Texas (principal office) and New Orleans, Louisiana. Mr. Herman can be reached at (214) 624-9805 and jherman@herman-lawfirm.com.

Jonathan M. Herman is on the Roster of Arbitrators for the American Arbitration Association (Healthcare, Commercial) and a Neutral for the American Health Lawyers Association

Managed Care Litigation Update® is a registered trademark of Jonathan M. Herman, LLC. |